|

Earn to save is the first step to financial independence.Wealth creation starts with saving!In order to build wealth and invest for your retirement you need to earn to save and start accumulating income generating assets and surplus capital.

As I mentioned before, there are three distinct periods in ones financial life cycle, including:

The earn to save phaseIn general, from your early to mid 40’s, once people have got (most of) their spending and debt under control, you may want to start to use (some of) your 'surplus' earnings to save and invest for retirement. Without noticing, you have entered the "earn to save phase", i.e. the phase of your financial life cycle when you start to accumulate wealth. Make sure to take full advantage of income tax protected vehicles like a Cash-only ISA. More about ISA tax benefits. Realise that:

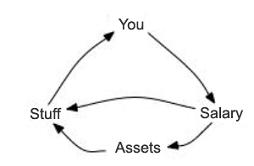

Your cash flow will look something like this:

To increase your future cash flow, you will need more income generating assets. The more you save and investment to more return you generateIt is really amazing how fast your accumulated capital can grow, especially if you are getting a good rate of return. For instance, a 7 per cent return will almost double your money in 10 years. Prudent early retirement investors can do even much better than 7 per cent over the long term. Financial independence in sight. . . .You become financially independent once your assets provide you with sufficient cash to cover all your current and future “stuff”. It does you no good, however, if your sole asset is your house –mortgage free– or if your money is sitting in a savings account if they provide little income. How many people do you know who became a millionaire with putting money into savings accounts? Nevertheless, as time passes by, you are about to enter the next stage of your financial life cycle: the Retire Earlier and Richer stage. Return from this page to Earn To Spend Page

|

What if you knew when high

quality dividend paying

shares are historically

undervalued or overvalued?

Wouldn't that be invaluable

information allowing you to

make much better informed

investment decisions?

Dividend Income Investor

1. shows you what we buy,

2. when we buy shares and

3. when we sell shares in

our own real-money

Dividend Income Portfolio

CLICK HERE to find out

By continuing to use this site, you agree to the use of cookies.

Click HERE to find out more about cookies and our Cookie Policy.

Follow me at Twitter, click:

Get live commentary on dividend paying companies and updates of our progress at Dividend Income Investor.com

As soon as you earn to save you start having income generating assets. You start getting an additional cash flow. Instead of spending this extra income re-invest for your retirement

As soon as you earn to save you start having income generating assets. You start getting an additional cash flow. Instead of spending this extra income re-invest for your retirement