|

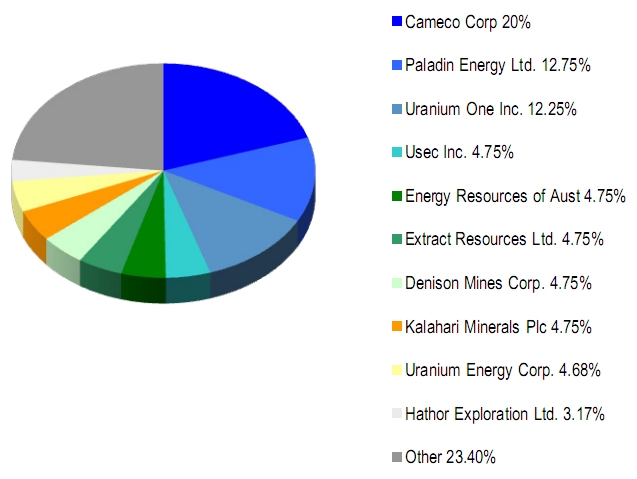

A niche uranium ETF solely focused on the most important uranium miners globallyThe Global X Uranium ETF, trading under "URA", seeks to replicate the Solactive Global Uranium Index which is designed to track solely the performance of the largest and most liquid listed companies globally in The Uranium ETF intend to invest at least 80% of its total assets in the securities of the Solactive Global Uranium Index companies and in depositary receipts based on the securities in the Index in approximately the same proportions as in the Index. The annual expense ratio amounts to 0.69 percent. Why invest in an ETF tracker such as URAInvesting in a concentrated uranium mining ETF such as the Global X Uranium ETF is an easy way to get exposure to the sector. URA is a welcome addition for investors looking for general exposure to uranium miners interested in benefitting in the supply/demand dynamics of uranium coming out of the ground. Regardless of where nuclear power plants are built, and who builds them, they will all need uranium and the increased demand that comes from these new plants is likely to create upward pressure on the uranium spot price helping all uranium miners. URA's compositionCurrently, the Uranium ETF is the most concentrated Uranium-themed ETF around. At launch - November 5th, 2010, it owned holdings in just 23 uranium miners and explorers. Follow the current composition of the Solactive Global Uranium Index.

Interestingly, at launch, at the country level, URA shows only four countries, including:

When looking at the individual holdings at launch of the ETF, one can only surmise that the entire weight for the UK covers Kalahari Minerals PLC which is listed in London but mines various resources out of Namibia. Also included in the Uranium ETF is Extract Resources - 41 per cent owned by Kalahari Minerals- , and several other miners with uranium activities in Namibia and elsewhere but which have their main listing in Australia. Most of the holdings of URA are on foreign exchanges. Whilst listed on the New York Stock Exchange, with this ETF you obtain exposure to the international uranium mining industry without the hassle of foreign trading. There are several other uranium mining and nuclear energy related trackers and ETFs that I am aware of each with varying amounts of uranium mining and nuclear energy exposure, including:

Return from this Page to Nuclear Power

Return from this page to Home page

|

What if you knew when high

quality dividend paying

shares are historically

undervalued or overvalued?

Wouldn't that be invaluable

information allowing you to

make much better informed

investment decisions?

Dividend Income Investor

1. shows you what we buy,

2. when we buy shares and

3. when we sell shares in

our own real-money

Dividend Income Portfolio

CLICK HERE to find out

By continuing to use this site, you agree to the use of cookies.

Click HERE to find out more about cookies and our Cookie Policy.

Follow me at Twitter, click:

Get live commentary on dividend paying companies and updates of our progress at Dividend Income Investor.com